Umbrella Insurance Policy

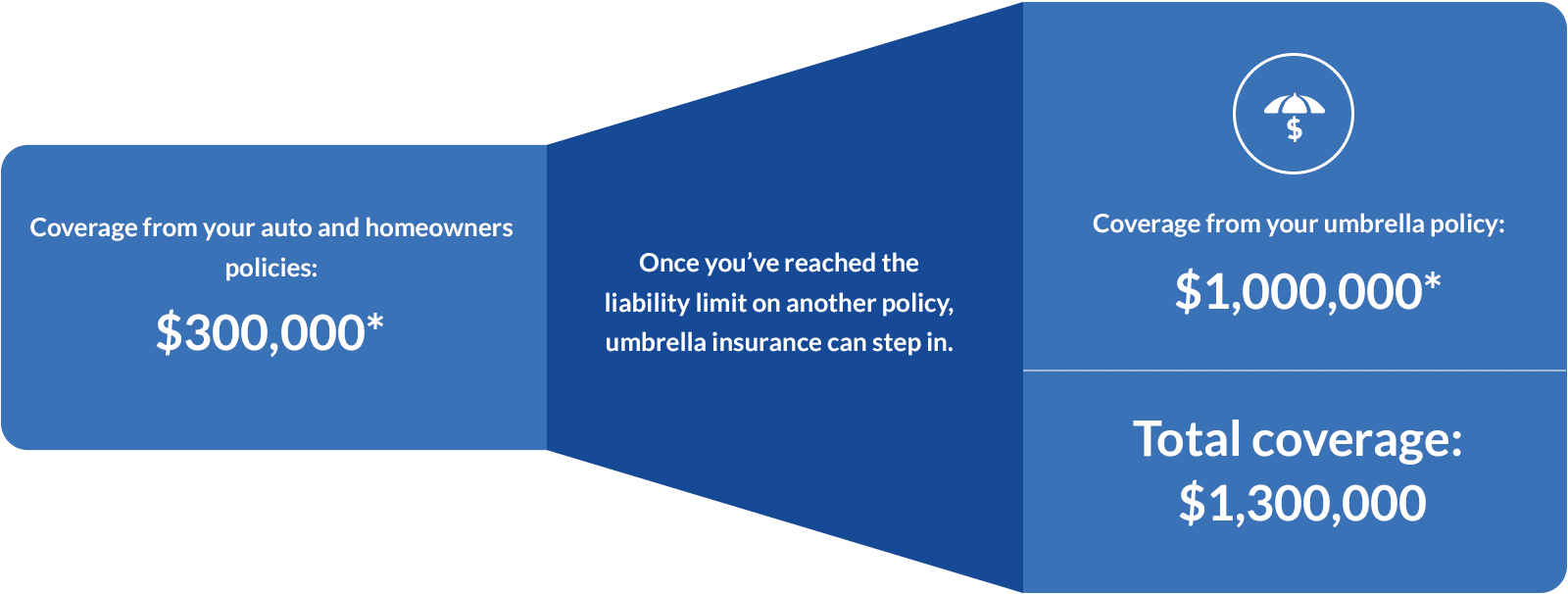

Umbrella Insurance Policy. Umbrella insurance is a type of personal liability insurance that covers claims in excess of regular homeowners, auto, or watercraft policy coverage. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies.

Umbrella insurance supplements your basic liability policies on your auto, home, or renters An umbrella insurance policy covers liability.

An umbrella insurance policy from Liberty Mutual provides additional liability coverage that goes beyond the limits of home and auto policies.

Umbrella insurance covers for claims that are often excluded by liability insurance policies, such as false arrest, libel How much does umbrella insurance cost? An umbrella insurance policy provides an extra layer of protection beyond what your regular insurance policies for homeowners, auto, business, specialty—like boat and RV—provides. It can help to protect your assets if you're.

0 Response to "Umbrella Insurance Policy"

Posting Komentar